Gabi Roworth

Whether you were for or against Brexit, it was evident that unless the UK decided quickly, significant uncertainty could be on the horizon for all countries involved. UK passport holders, it is time to pay attention!

‘Legally binding’ changes were secured to the Brexit agreement that was overwhelmingly rejected in November

Theresa May failed to convince Parliament to continue with her divorce deal. She must approach the EU requesting an extension past March

29, ideally to 30 June 2019.

A secondary vote, entertaining the possibility of a no deal Brexit, failed

A final vote was held affirming continuing with Brexit.

EU negotiators expressed their wishes to delay no longer than May 22.

After three years since the majority of citizens voted for Brexit, the UK has been left in a chaos of uncertainty. Decisions on trade,

customs and citizens’ rights are still up in the air with no guaranteed resolution any time soon. Bookmakers have cast the odds at 2/1 of

Brexit not occurring before the UK general election, and another referendum being held. Current polls indicate if this were to happen, the

REMAIN vote would prevail.

Seems risky to be playing deal or no deal with European Union. In support of May, German Chancellor Merkel said she will fight until the

last moment to ensure an orderly Brexit, due to this decision affecting the interests of Germany, Britain and the entire EU. Investors were

advised by Citibank to avoid the pound as the political chaos threatens any uncertainty-avoiding strategy.

Caitlin Philp

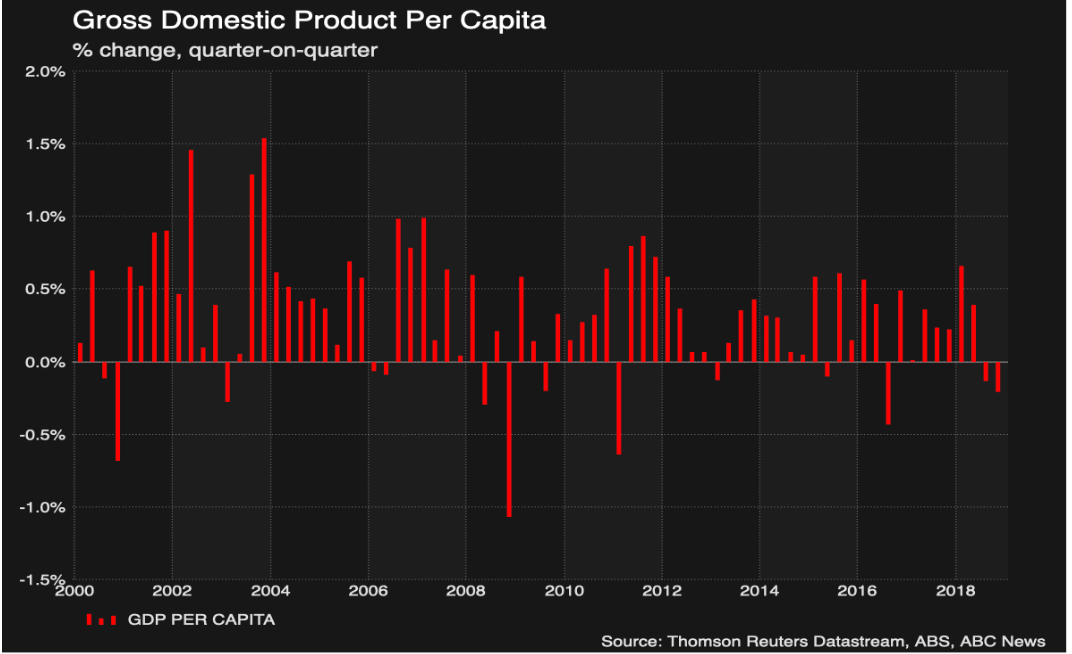

After reports of sluggish growth figures for the final 3 months of last year, the OECD has warned that Australian (and global) growth will

slow even further. The economy only grew 0.2% in the December quarter, but this figure looks even gloomier when spread to a per capita (per

person) basis, dropping by 0.2% after a previous-quarter decline of 0.1%. Australian population growth averages 0.4% per quarter,

so a per-capita recession means that population growth is surpassing output factors of consumption, investment, government

expenditure and net exports. This has only been seen two other times since 1991, when a swathe of regulatory and investment restructuring

occurred under the Keating government.

From the RBA’s standpoint, the slowdown is attributable to low wage growth (at 1.7%, which is below the inflation rate) combined with decreasing wealth due to falling housing prices – houses are an asset so when value drops, spending decreases as people feel their ability to spend tighten. Treasurer Josh Frydenberg maintained that the ‘economy is in fundamentally good shape’ with only 5% unemployment (the lowest level in 7 years). He says the figures merely represent ‘some moderation on the back of strong results’, and has pointed to the extended periods of drought, lower mining investment and a decline in residential construction, which contributes 15% of our GDP.

Into the future, this is a burden for the government to carry to the May election and clearer governmental direction has been advised by

both the Business Council of Australia and the Chamber of Commerce in order to aid investment activity. Sluggish growth also influences the

monetary policy conducted by the RBA, and some economists have slashed predictions for official interest rates to drop to a record low of 1%

by September. Exchange markets did not take well to the forecast, with the AUD dropping to a two-month low of $US0.703, though these

symptoms of slowdown are being experienced internationally.

Nathaniel Cummins

Chinese tech-giant Huawei has been rapidly embroiled in scandalous headlines over the past year. The telecommunications and consumer electronics manufacturer has been continually accused of allowing the Chinese Government back-door access to all their products’ data and communication systems. As early as 2012, cracks began to show as a US congressional panel labelled Huawei a national security threat, leading to a ban being placed on all Huawei contracts with the US.

Fast-track to July 2018: Huawei reached a high, finally surpassing Apple to become the world’s second largest smartphone manufacturer. Only a

month later, the Australian Government decided to exclude Huawei from involvement in their construction of a 5G Network due to security

concerns. Three months later New Zealand followed suit, thus denying the multinational two large telecommunication contracts. Only 3 days

after this development, Huawei’s CFO, Mang Wanzhou (also daughter to founder Ren Zhengfei) was arrested in Canada for breaking US sanctions

by falsifying financial statements to cover up deals with Iran.

This isn’t the first time Huawei has been involved in unsavoury business relations; in 2014 they signed a deal with Syria to build up their

telecommunications systems and have been accused (by the US) of having dealings with North Korea. Following the trial Mrs. Wanzhou was

extradited to the US. She has since countered these developments with a countersuit against the Canadian government regarding the management

of her arrest. Huawei has also fielded a lawsuit against the US government in regard to the ban of their products being used by Federal

agencies.

Throughout all these disreputable events, Huawei has managed to maintain most of their business even if their public image has been damaged.

Their telecommunications systems are essential infrastructure in most developed countries and would take years to replace. Therefore, even

though Huawei is barred from involvement in nearly all new projects, they are still under contract to maintain their current systems. The

Huawei controversy won’t be over for a while, as only a few days ago the Western Australian Government allocated them a contract to

construct and manage telecommunications and data services for Perth’s rail network.

If there were any topics in this article which you’d like to learn more about like monetary policy, market fluctuations or just GDP,

get in contact through our UQBA social media channels.